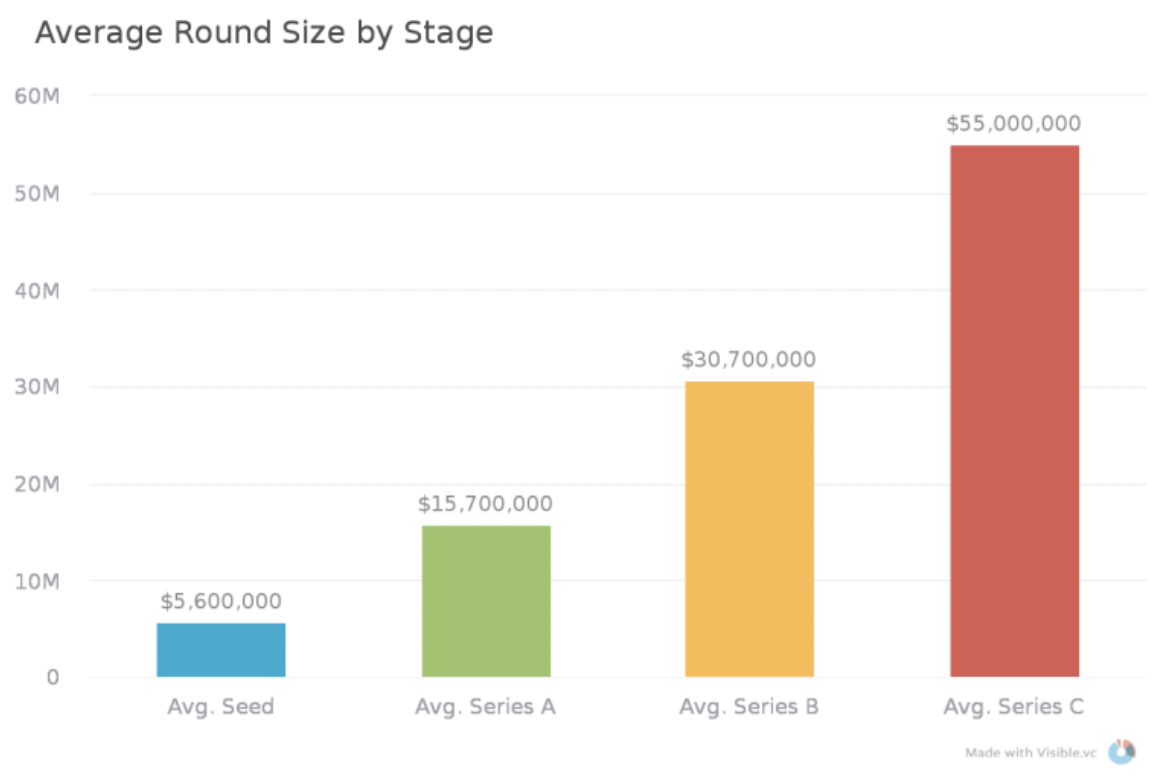

The process of starting and growing an early-stage company usually involves several stages of funding. These stages represent the different phases of development a company goes through and the different types of startup funding stages that occur in a business cycle. The funding stages highlight the company’s progress, such as seed capital funding for initial growth provided by seed investors, seed series A for product development and market validation, Series B funding, Series C funding and Series D funding for scaling the business progressively. Each funding stage requires groundwork, consultations, and due diligence which creates the need for more specialized effort as time progresses.

The Pre-Seed Stage

Pre-seed investments are usually needed before the latter stages of venture capital begin. The pre-seed investments in pre-seed stages can come from angels, accelerators/incubators, and specialized VC funds.

Typically, pre-seed funding rounds range from $100,000 to $5M. Some startups may need less or more, depending on the investor’s interest and the company’s needs. The best way to determine the right funding amount for you is to evaluate your needs, analyze the firm’s burn rate, and analyze with investors and advisors.

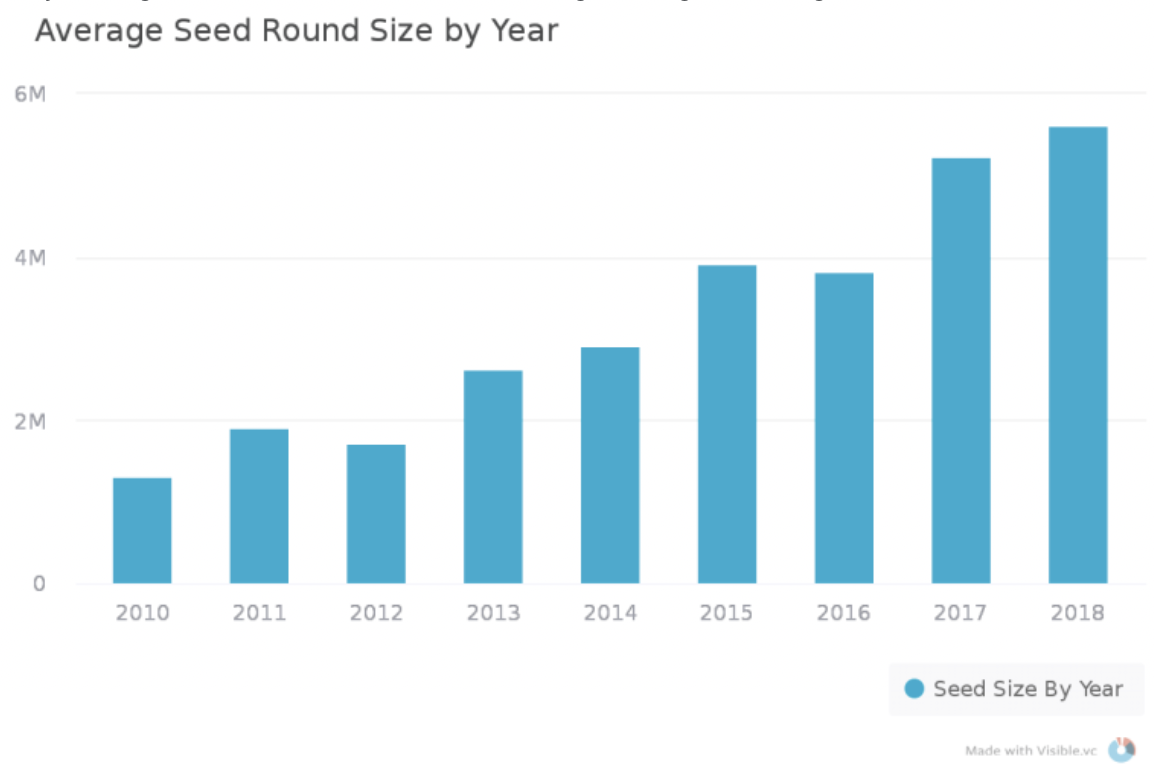

The Seed Stage

Seed investing is the start of the startup funding stages process. They are provided by seed investors such as angel investors, venture capitalists, or seed-stage venture funds and are used to cover the expenses of R&D, product development, and other outlays needed to get the business up and running. Newbie entrepreneurs find it easier if they have access to networks that build the future of their business. If the right investors are around, things become much easier. The amounts of seed capital funding vary depending on the industry, the business lifecycle stage, and the investors. Seed investing is thought of as high-risk.

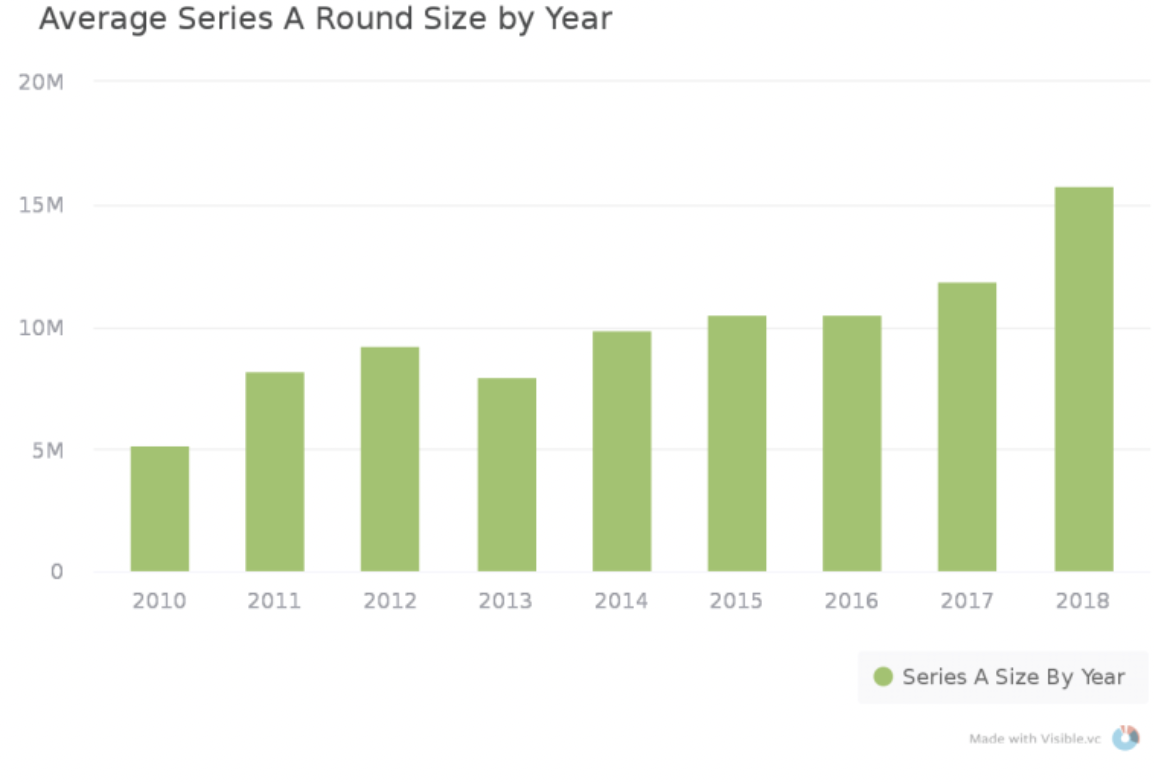

Series A Funding

Seed Series A funding is a stage of venture capital wherein a startup wants to grow and expand its operations and develop its true market potential. Companies at this point in time have proved that their business models work and have strong financials to back that up. In 2022, the median Series A funding totalled $15 million. More of the established VCs participate in Series A funding; companies such as Sequoia Capital, Google Ventures, and Intel Capital.

How to Get Series A Funding:

- By using an Angel Netwrok – One-third of startups that raise Series A funding go through angel and vc networks like Beej Network.

- Expanding your Network – connecting with investors always helps in the long run.

- Continuing to build on your Network – networking the right way means putting in work to maintain relationships with the stakeholders of your business, you can try Beej Network for a start.

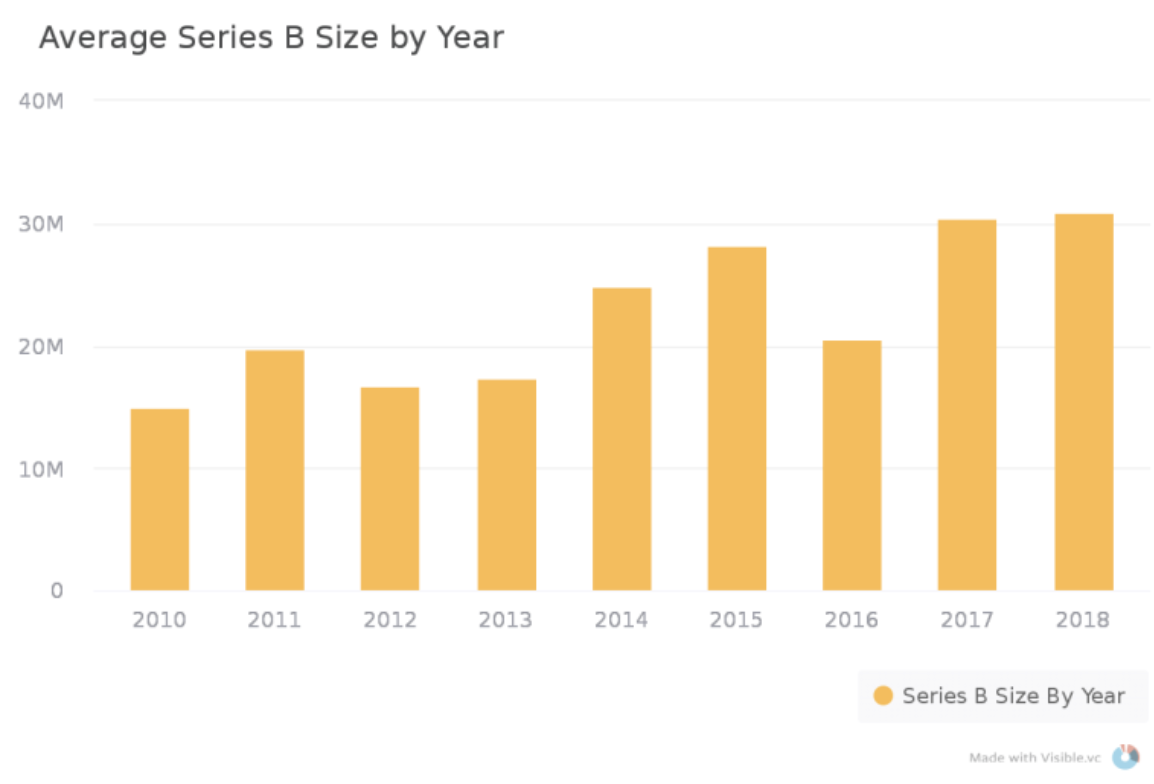

Series B Funding

Series B Funding is the second in a series of funding rounds to help expand and take your company to the next level of success. They are typically the sale of preferred stock to venture capitalists and at this stage of funding, businesses need to boost business development, sales, advertising, tech, support, and talent. Strategic investors at Beej Network usually bring valuable connections as well as funding.

Series C Funding

Series C Funding is the next round of venture capital funding after Series B. Businesses want to focus on scaling and growing more than ever. Big financial groups like hedge funds, investment banks, and private equity firms are in this funding round. There could be incoming requests to invest at this point from investors because the startup has proven itself to be successful and promised more financial success down the line. The average amounts in this stage are $30M to $100M.

Series D Funding

Series D funding might occur if the investments received in Series C weren’t satisfactory. Some companies might opt for this because they weren’t happy with how much they raised at the Series C funding round. Not a lot of firms make it to Series D, or beyond. Series D rounds usually devalue a company which could mean trouble for investors. Costs here are needed to be met because the business might face survival challenges.

Series E Funding

Again, if the previous investment round wasn’t sufficient, another round might be needed. Businesses here usually only need money because it hasn’t been able to make up their own capital back and is fighting to stay private and active.

Series F & G Funding

While still possible, very few companies make it here. Some companies usually raise capital just as a ‘way of doing business’ although it always runs the risk of being diluted more and more. The important thing to understand here is that each series typically comes with new investors with different terms than previous rounds.

Summing It All Up

While this might seem like a lot of funding rounds to go through, know that each business has a different purpose, and along with that, its needs and expenses vary too. There are a lot of companies that need fewer funding rounds to grow and expand as compared to others. As a business owner, you have to ask yourself at which point of the business lifecycle you’re in, where you would like to be next, and what it would take for you to get there.

Also read related blogs.

Over many years of work, we have built a very successful history in our area of expertise.